Green(er)houses Without the Money Tree: Financing Your Next Upgrade Without Breaking the Bank

Green(er)houses Without the Money Tree: Financing Your Next Upgrade Without Breaking the Bank

Financing Your Next Upgrade Without Breaking the Bank

Greenhouse growers face a dilemma. For many, a large-scale operation is profitable, using technology and infrastructure that’s worked for decades. However, with rising energy costs and looming deadlines to reduce carbon emissions, many of you are now seeking to modernize your operations and explore more energy-efficient models.

Unfortunately, the landscape for financing such projects is complex and highly localized, with regulation and compliance varying across national borders. It can be a minefield trying to determine which form of financial support may suit you best, from leveraged finance, equity and angel investment, to crowdfunding or even government grants. Then it becomes a question of how to access those funds in a way that keeps the balance sheet healthy and does not put the company at an unreasonable level of risk.

When faced with the question of how best to spread your risk and maximize your return, it’s always best to speak with a financial expert with experience in your local market. However, it’s equally important to know what sort of options are available and what questions to ask when you walk into that meeting.

To give you a strong foundation for future conversations, we sat down with Aquila Capital, our European financing partner and expert in helping companies upgrade their heating and lighting systems to more energy-efficient solutions, to outline some of the key considerations for growers exploring how best to finance their future business success.

1. Work the plan, then work the financing

Too often, when large growers look at their options for expansion or an operational upgrade, they start with what they think they can afford or secure in finance and then try to work out how best to spend it. This approach can automatically limit your thinking, ranking elements of a plan in terms of priority (often meaning that the easiest wins slip to the bottom of the list), rather than looking at the pieces of the jigsaw puzzle as a whole.

It can also encourage growers to overextend themselves, financing their upgrade projects through large blocks of secured debt that sits on the company books as a liability, making it less attractive to investors and providing a source of ongoing financial pressure for the business.

“You cannot finance everything with debt,” comments Bruno Derungs, Senior Investment Manager with Aquila Capital’s Energy Efficiency Team. “And many companies don’t pursue energy savings if they don’t have the capital and don’t believe they can secure the financing. This is why so many continue to use older, inefficient systems despite a growing desire to switch to more modern technology.”

With so many potential options on the table to help growers prepare their operational infrastructure for future growth, it’s beneficial to take a longer-term view than what you believe you can secure in the short term. Plan for where you want your business to be in five to ten years’ time and then investigate the different financing options. You may be surprised at what you can afford and how such investment could transform your business for the better.

2. Tap into local support

In certain areas, particularly those with environmental benefits, local and national governments are ringfencing greater financial support in the form of sustainability grants and low-cost borrowing to support their global carbon reduction commitments. The EU plans to mobilize €1 trillion of investment by 2030 in order to reduce greenhouse gas emissions by at least 50% from 1990 levels. Of this, €400 billion will come from private and public sources. Help will be available in different forms for companies taking concrete steps towards a carbon neutral goal, and both public institutions and private finance are starting to think creatively about how to support these goals.

Meanwhile, in North America, many utility companies work with the Design Lights Consortium (DLC) to offer rebates toward the purchase of qualified lighting products to reduce the load traditional lighting fixtures place on the grid. A fixture must pass a range of industry tests and requirements to be listed with the DLC. Current has a helpful rebate lookup tool to help you find the rebates available to you. Always check with your utility provider to make sure you aren’t leaving money on the table.

3. Invite your partners to share some out-of-the-box thinking

Technology partners tendering for your business may have more knowledge of and access to flexible, affordable ways of supporting their part of the project. Ask your technology or equipment suppliers for advice. Once they’ve been shown to have the best solution or technology to meet your goals, see what financial options or funding partners they are working with, and what benefits there might be for you.

4. Convert CapEx to OpEx and protect your balance sheet

Imagine your current operation as it stands. Every month you have your typical operating expenses: electricity costs, perhaps additional fuel if you use a diesel generator, water, growing media, seeds, plants, fertilizers, etc. If you’re still using traditional lighting and a diesel generator, you’re already paying way more than if you switched to more energy-efficient, greener alternatives. Yet the upfront cost of such an upgrade is not insignificant, even if the savings and environmental benefits dwarf the investment overall. Unfortunately, this often means that some growers don’t pursue energy saving-driven upgrades as they don’t have the initial capital to support it.

Where there is such a clear environmental benefit, there are ways to remove the risk of that initial capital outlay and convert it to an ongoing operating expense that is no higher than the current running costs of the business. This is an approach that a number of our customers are investigating through our financing partner, Aquila Capital.

“Aquila Capital has taken a tried and tested leasing model and applied it, with a twist, to a new generation of energy-saving technology financing,” comments James Fleet, Commercial Manager, EMEA at Current. “We work with Aquila to help our customers upgrade their systems to equipment that offers a longer-term benefit to them financially, as well as to the planet. Lots of companies are talking the talk, but Aquila is the only partner we’ve found with the experience and expertise to deliver on the promise of low-risk, low-cost finance for a greener future.”

The first step in this process is to identify the running costs of your current lighting installation (in terms of monthly energy bills, maintenance, and replacement costs of existing lamps either through failure or periodic replacement). Aquila then reviews the viability of funding the initial LED upgrade and calculates a repayment schedule from the difference in energy costs and reduced maintenance compared with the legacy system. Your monthly operational expenses stay at the level they were prior to the upgrade, but you have a healthy balance sheet as well as more efficient, effective, environmentally friendly lighting that future-proofs your operation for the coming years.

It’s even possible to combine lighting and heating technology upgrades into one “energy savings as a service” package, converting traditional bulbs to LEDs and diesel generators to biomass units.

“With this approach,” notes Derungs, “you have the opportunity to take a greener position as a company, without investing any of your own money. You can deploy more advanced technology, with the potential to make even greater environmental and financial savings in the process, because you can afford it and the risk is removed from your balance sheet.”

For a theoretical example…

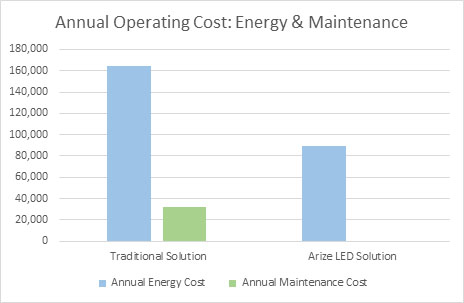

Imagine an operation with 454 1000W HPS lighting fixtures, running 6 hours per day. At 0.15 euros per kWh, your annual electricity bill is around €164,053, plus annual maintenance and install costs of approximately €31,780 and €22,700 respectively. To replace these with Current’s Arize® Element L1000—a direct 1:1 replacement for 1000W HPS—the initial cost to install the same number of luminaires is €283,750. However, the annual energy and maintenance savings (estimated at €106,350 based on this scenario) gained from switching to LED means that entire capital investment would be repaid in under three years, simply by maintaining the OpEx at its current level for the business and putting the savings towards capital repayment.

As the financing is spread over a five-year period, aligned to the warranty offered on the LEDs, growers can even reduce the annual operating expenses listed on their balance sheet, releasing more cash for the business and offering greater security for future planning.

By establishing this model, we’re not only making going green affordable, we’re also providing a beneficial financial strategy for growers. With the lender taking on the risk and removing the high capital expenditure from the company’s books, growers can preserve cashflow, present stronger financials to boost their credit rating and secure other forms of leveraged finance to invest in scaling their business.

5. Work with experts in your local and regional market to secure the best deal

Despite the pressure to boost productivity, save energy and reduce your carbon footprint at a global level, at a national and regional level, the avenues available to growers looking to scale their operations or retrofit an established infrastructure with new technologies can vary. It’s impossible to say that one specific financing option is available to any grower in every region, so it’s important to work with an established lender with experience in this area, who understands the changing local compliance landscape and can advise you accordingly.

With more governments signing up to global sustainability goals, local financial regulation can become more fluid, offering new ways to support green initiatives and introducing new penalties for maintaining inefficient, legacy operations.

With the help of the right financing experts and technology partners, you can explore the right balance between CapEx and OpEx to strengthen your balance sheet and prepare your business for its next phase of greener growth.